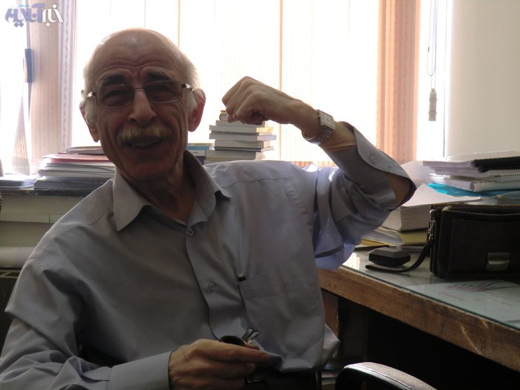

Khabaronline filed an interview on November 16 with Mehdi Taghavi, an economic analyst and a member of faculty at Allameh Tabatabaei University, about the likely ramifications of a recent drop in oil prices on Iran’s economy. What appears below is the translation of part of the interview:

Since oil prices on the global market have hit a 4-year low and international institutions have projected that the prices will see additional decline in 2015, concerns among oil producers have heightened.

OPEC (Organization of the Petroleum Exporting Countries) has reported that countries whose economies are dependent on oil revenues should sell their crude at no less than $100 per barrel to balance their budget. However, over the past few weeks, oil prices have plunged $20 below that level.

In the run-up to a 166th ministerial meeting of OPEC, Iran’s oil chief Bijan Namdar Zanganeh said that a return to $100-plus prices is difficult but that prices should be set in keeping with what the market warrants.

The question is how Iran’s economy which is dependent on oil revenues will fare in the months to come. Masoud Nili, an economic advisor to President Rouhani, says realistic projections about crude prices and oil revenues must be taken into consideration in putting together the spending package and steering the economy, especially now that it is in recession and the way out passes through a more active development sector.

Mehdi Taghavi is of the opinion that the fall in oil prices will have a serious impact on Iran’s economy and its budget plan.

“Traumatic effects lie ahead, because Iran’s economy has been long dependent on oil revenues. Oil is Iran’s staple export item and if we want to keep our economy afloat, oil exports will have to go according to plan. However, global oil prices are slumping by the day, this might send shockwaves into our economy,” he said.

He went on to say, “As oil prices dive, there will be a fall in foreign currency revenues. A decline in exports will see imports go down and send inflation surging.”

Estimating that a constant drop in oil prices will take a toll on production in industrial units, he added, “The government should not turn to quantitative easing to ride out the budget deficit, because such a measure will fuel inflation.”

“From my perspective, in these conditions, no matter what the government does, it will harm the economy. The government might be advised to lower its spending, but will it help put our financial house in order? In my opinion, it won’t, because the question is what sector can survive a reduction in spending. Anyway, I am of the conviction that the decline in oil prices will shock Iran’s economy to the core,” he concluded.