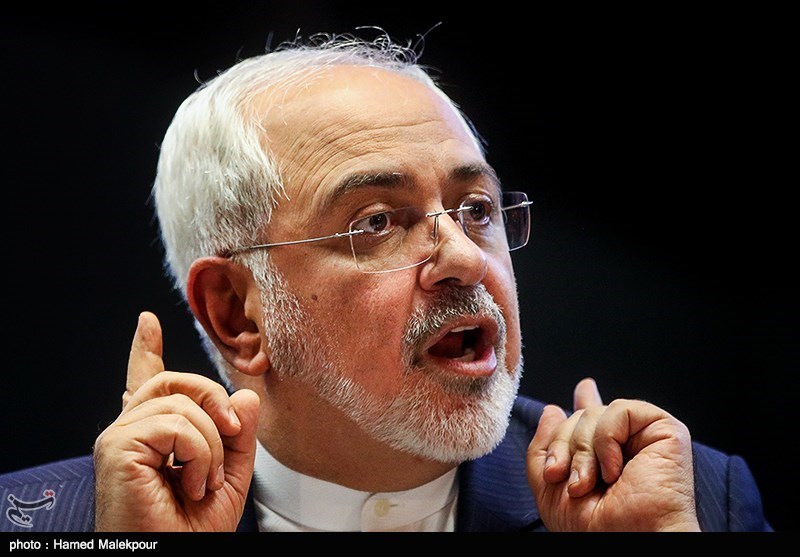

Addressing a conference on Iran-Europe trade and banking ties, held in Tehran on Saturday, Zarif said Washington’s decision to seize $2 billion in the Central Bank of Iran’s assets held in New York’s Citibank or its push to put a freeze on $1.6 billion in assets belonging to Iran are “undoubtedly an international banditry.”

In April 2016, the US Supreme Court upheld the Congress and then President Barack Obama’s actions to hold Iran financially responsible for the 1983 bombing that killed 241 Marines at their barracks in the Lebanese capital of Beirut. The ruling allowed the families of the Marines and victims of other attacks that courts have linked to Iran to seize some $2 billion in assets held in New York’s Citibank, belonging to the Central Bank of Iran (CBI), which had been blocked under US sanctions.

Also in 2011, victims of the September 11 attacks, launched by Saudi-backed al-Qaeda in 2001, persuaded a federal judge in New York, George B. Daniels, to find that Iran had aided the attacks by providing assistance to al-Qaeda. In 2012, he ordered Iran to pay the victims $2 billion in compensatory damages and $5 billion in punitive damages.

That judgment stagnated for years because there was no obvious way to collect it. But then it came to light that the Clearstream system in Luxembourg, which facilitates international exchanges of securities, was holding $1.6 billion in Central Bank of Iran’s assets that had been blocked under sanctions.

Last year, lawyers for the September 11 victims persuaded a judge in Luxembourg to place a new freeze on those assets while they sued over whether they could execute the default judgment against those funds.